Lower than expected 2021 property taxes should yield credits for many owners of Walt Disney World-based Disney Vacation Club resorts, savings which may continue in 2022 and beyond.

Owners at Disney's Polynesian Villas & Bungalows are among those due a refund for over-estimated 2021 taxes

The Disney Vacation Club resorts at Walt Disney World have received their property tax notices for 2021. Tax rates have gone up for 2021 but property appraisals are significantly lower than the year before. The net effect is that the tax bills for 2021 are lower than what had been estimated when the DVC budgets were approved in December 2020.

Property tax amounts are based on two factors: Appraisal values and the millage rates set by the taxing authorities.

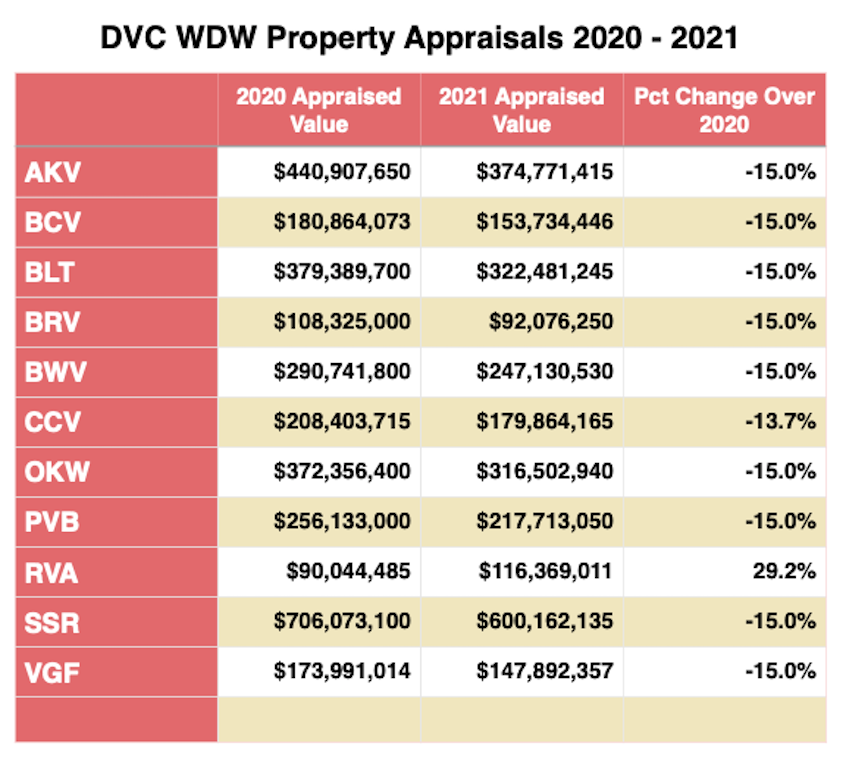

In 2021, appraisal values were lowered for all ten of the fully declared DVC resorts. The only DVC resort that saw its appraisal value increase was Disney’s Riviera Resort, which began operation in December 2019 and is not yet fully declared for DVC. Until the resort is fully declared, Riviera’s value will continue to increase from year to year.

The Orange County Property Appraiser reduced the appraisals for nine of the ten fully declared resorts by exactly 15%. The only fully declared resort that did not have its value reduced by 15% was Copper Creek Villas & Cabins at Disney’s Wilderness Resort; its appraisal was lowered by only 13.7%. Riviera saw its value increase by 29.2%.

For some resorts, their 2021 appraisal values are their lowest in several years. Disney’s Animal Kingdom Villas hasn’t been below $375 million since 2014 when it was assessed as $356.9 million. Disney’s Old Key West Resort and Disney’s Saratoga Springs Resort & Spa also have current appraisals that are at their lowest amounts since 2014.

There is no explanation as to how the Orange County Property Appraiser arrived at the 2021 appraisal values for the DVC resorts. For years, Disney battled with former county appraiser Rick Singh over non-traditional valuation methods which caused rates to soar around 2015. In 2020, a court case involving appraisal values for the Disney's Yacht Club Resort was settled with the verdict generally in favor of Disney’s request for lower property values. Whether the decision in that court case had any bearing on how the DVC resorts were appraised in 2021 is open to speculation. Voters replaced Singh with new appraiser Amy Mercado during the 2020 elections.

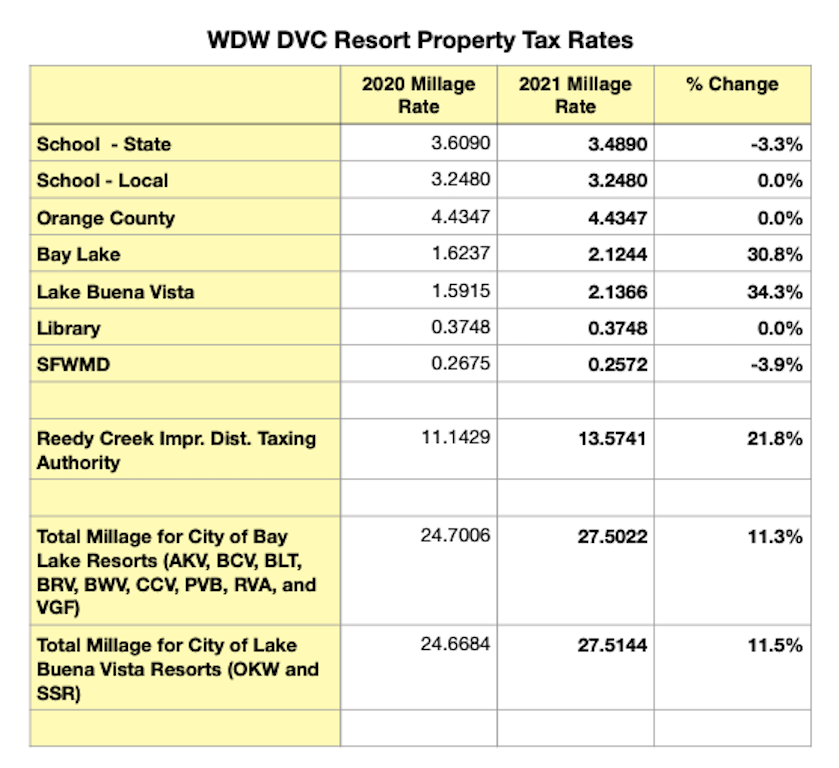

In addition to its property appraisal value, a resort’s tax bill is dependent on the millage rates set by the taxing authorities in whose jurisdiction the resort resides. Each DVC resort is subject to taxes levied by seven taxing authorities, including a city property tax. Old Key West and Saratoga Springs are taxed by the City of Lake Buena Vista, while the other nine resorts are subject to taxation by the City of Bay Lake.

Both City governments increased their milage rates for 2021 by more than 30%. The City of Bay Lake raised its millage rate from 1.6237 per $1,000 of assessed value to 2.1244, up 30.8% over the prior year. The City of Lake Buena Vista rate went from 1.5915 to 2.1366, an increase of 34.3%.

Additionally Reedy Creek Improvement District accounts for almost half of the total millage rate for the DVC resorts. In 2021, RCID raised its rate 2.4312 to 13.5741 per $1,000, an increase of 21.8%.

Other components of the tax include:

- The School tax rate set by the State decreased a modest 0.1200 per $1,000 of assessed value, a drop of 3.3%.

- South Florida Water Management District decreased its millage rate by 0.0103, which is a 3.9% drop compared to 2020.

- The School tax rate set by local government, the Orange County General tax rate, and the Library authority all kept their millage rates the same as in 2020.

The combined effect of these changes in millage rates is that the tax rates for the two DVC resorts taxed by the City of Lake Buena Vista — Old Key West and Saratoga Springs — are rising in 2021 from 24.6684 to 27.5144 per $1,000 in value, an increase of 11.5%. The other nine DVC resorts that are within the jurisdiction of the City of Bay Lake have their tax rates rising from 24.7006 to 27.5022, an increase of 11.3%.

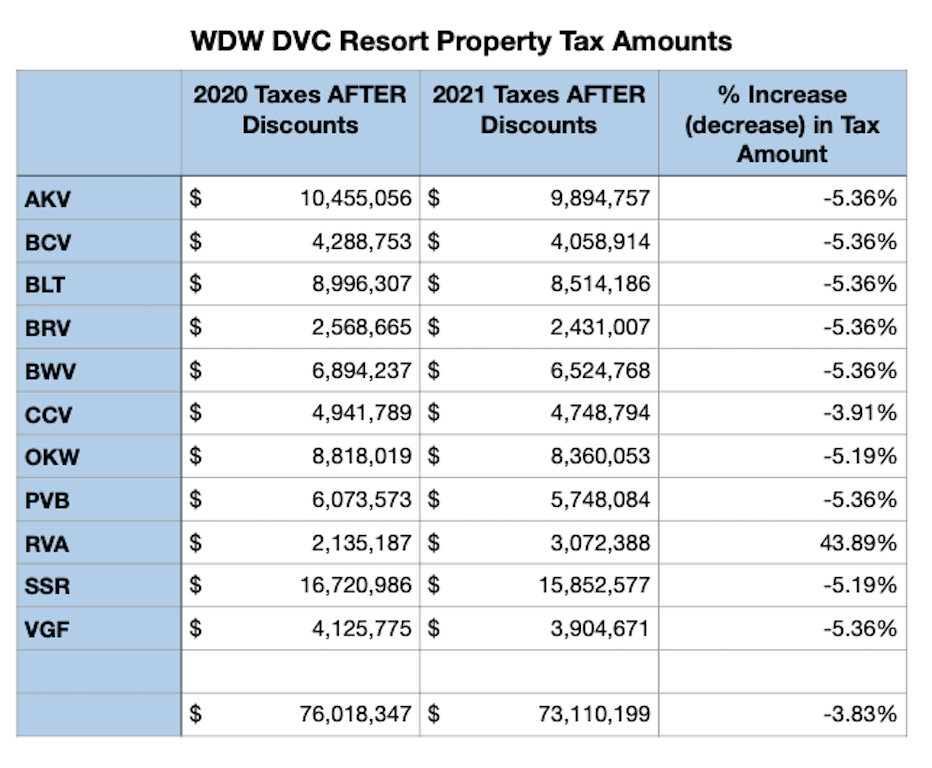

Despite the increase in millage rates for 2021, the DVC resorts should see a lower tax bill for 2021 than originally estimated. The amount of the decrease should range from 3.9% to about 5.36%. In absolute terms, Riviera has the largest increase in its tax bill, but this will be offset by having more of the resort declared into the timeshare program.

Excess collections are typically credited to the following year's Annual Dues. Barring a change in methodology, Disney Vacation Club owners can expect to see credits applied to their 2022 dues to compensate for the over-estimated 2021 taxes.

It is unknown what accounts for the increase in RCID’s millage rate for 2021. RCID’s FY 2022 operating budget shows it is increasing expenditures in FY 2022 by $8.8 million to $19.6 million for “Planning & Engineering - Repair & Maintenance”, up more than 82% year-over-year. This is the single largest increase in RCID’s FY 2022 budget over its FY 2021 budget.

Based on these property appraisals and millage rates, the eleven DVC resorts have a cumulative tax bill for 2021 of $73,110,199. This cumulative figure reflects a 4% discount for taxes paid by November 30. Historically, Disney has always paid property taxes by that date to take advantage of the full discount.

Wil Lovato is a contributor to DVCNews.com and has been a Disney Vacation Club owner since 2009. His DVC Home Resorts include Copper Creek Villas, Bay Lake Tower, Animal Kingdom Villas, and Aulani. He can be found posting on many Disney discussion forums under the username of “wdrl.”